The Investor June 2021

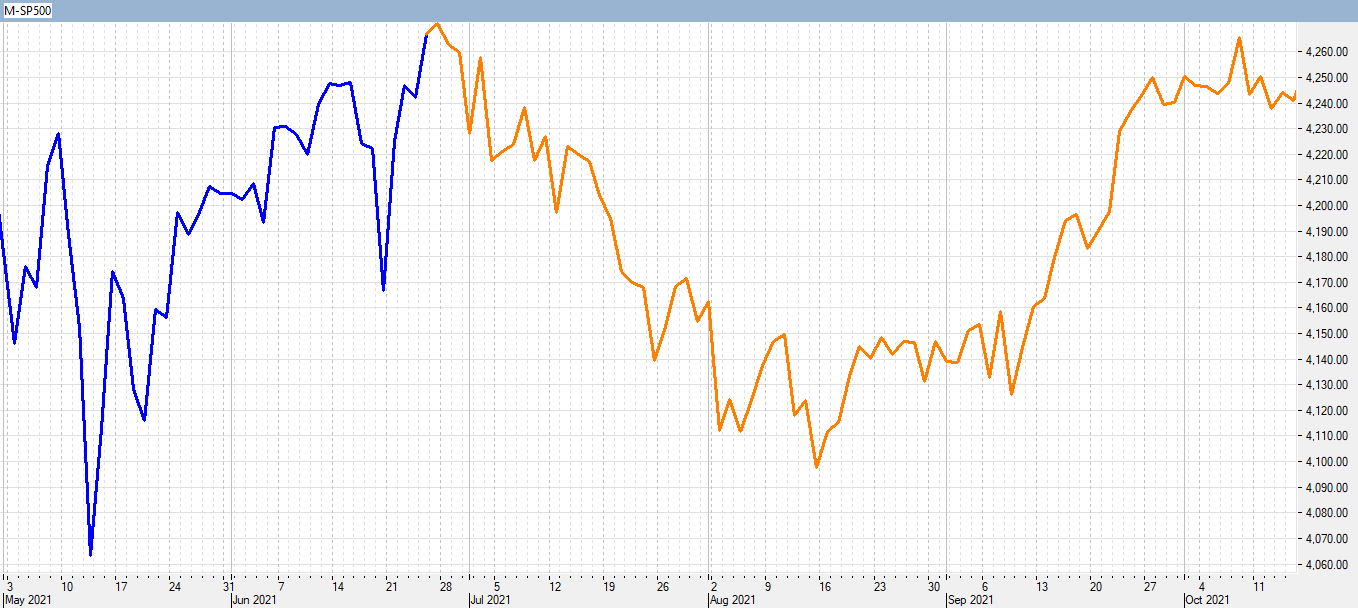

ShareFinder’s prediction for Wall Street for the next three months:

News from ShareFinder

Ever intent upon leading from the front, ShareFinder International is about to launch its own cryptocurrency, the ShareFinder, and has simultaneously released a new ‘Quick Access’ version of its ever-popular Mobile analysis software.

The cryptocurrency launch, backed by ownership of shares in the international holding company responsible for developing of ShareFinder software, will also confer a three-months free trial of the new Mobile software together with reduced premiums thereafter upon everyone who invests in a minimum number of the ShareFinder blockchain coins.

The new developments are the result of Sharefinder International’s determination to remain in the forefront of global investment technology which the Covid-19 pandemic has greatly accelerated; notably the remote office, fractional share market trading and the coming to the fore of the blockchain algorithm. But these are merely the tip of an immense economic iceberg that been building up beneath the surface of general consciousness for many years.

No longer, for example, the exclusive domain of youthful computer geeks, universal acceptance of blockchain currencies has thrust the concept to the forefront of international monetary development and is in the process dramatically re-shaping the fundamentals of the global monetary system.

Recognising that the blockchain system is introducing change infinitely more dramatic than the 20th Century move into metrication which so profoundly increased modern business efficiency, it is already irrevocably re-shaping the way the global banking system operates and, with it, it appears inevitable that world governments will soon have to radically revise their methods of tax collection which suggests in turn, the dramatic probability that democracy as we understand it is likely to be totally re-shaped.

Though it is a given that a fight back is gathering speed in the form of governments attempting to use legislation to turn back the tide of inevitability because they are only now beginning to appreciate the threat the blockchain poses to the centrality of their power, they are clearly destined to lose the battle before the immutable force of mass public opinion. Carried to its logical conclusion, as I hope to explain, politicians whose selfish interests have had a huge bearing upon our decades-long history of dreadful monetary policy, face an imminent threat of extinction. The threat, furthermore, has come at time when politicians as a species are arguably at a height of public unpopularity which has, possibly terminally, incapacitated their ability to fight back.

Lest you doubt this, a recent study found that only seven percent of Donald Trump’s statements were factually correct. The same study found the percentage of US politicians’ statements that were “mostly false ranged as high as 84 percent. Across the pond, latest edition of the annual British Social Attitudes Survey found that in 2019 only 15 percent of respondents said they trusted the government either “most of the time or “just about always,” which the pollsters described as the lowest level recorded in more than 40 years. Globally, the statistics come out more or less the same!

Lest you doubt this, a recent study found that only seven percent of Donald Trump’s statements were factually correct. The same study found the percentage of US politicians’ statements that were “mostly false ranged as high as 84 percent. Across the pond, latest edition of the annual British Social Attitudes Survey found that in 2019 only 15 percent of respondents said they trusted the government either “most of the time or “just about always,” which the pollsters described as the lowest level recorded in more than 40 years. Globally, the statistics come out more or less the same!

From the perspective of monetary systems, the likely eventual consequence of the development of the block chain equation will be a single world currency and the phasing out of orthodox stock exchanges, deeds registries and the like. Blockchains are thus heralding that a fundamental shift has occurred in the way our world financial system operates and that is why the ShareFinder team is moving rapidly to ensure it remains a leader in this field.

Leading world economists have long warned of the dangers of soaring global debt and the increasing risk of political pressure upon central banks to so manipulate interest rates that monetary institutions like pension plans everywhere face long-term collapse. Worse, the consequent volatility of currency values has ensured that the world has moved constantly through alternating boom and bust gyrations which, through rendering so many people unemployed, have robbed the world of much of its potential growth.

Unlike once-a-century social catastrophes like the current coronavirus pandemic, the man-made variety resulting from inept Central Bank money management has regularly destroyed livelihoods and, worse, has ensured that the average man has been unable to accumulate sufficient savings during a lifetime of diligent work to ensure a comfortable retirement at the end of his life. They have similarly applied a very effective brake upon mankind’s scientific progress.

Arguably too, had we not been obliged to endure these grotesquely un-necessary economic slow-downs, the world would long ago have solved most of the plagues which regularly threaten us with curses like Alzheimers, Cancer and children born with life-threatening health, emotional and mental issues, not to mention items like global warming, plagues, and governments whose ambitions for world dominance constantly threaten us with warfare and social devastation.

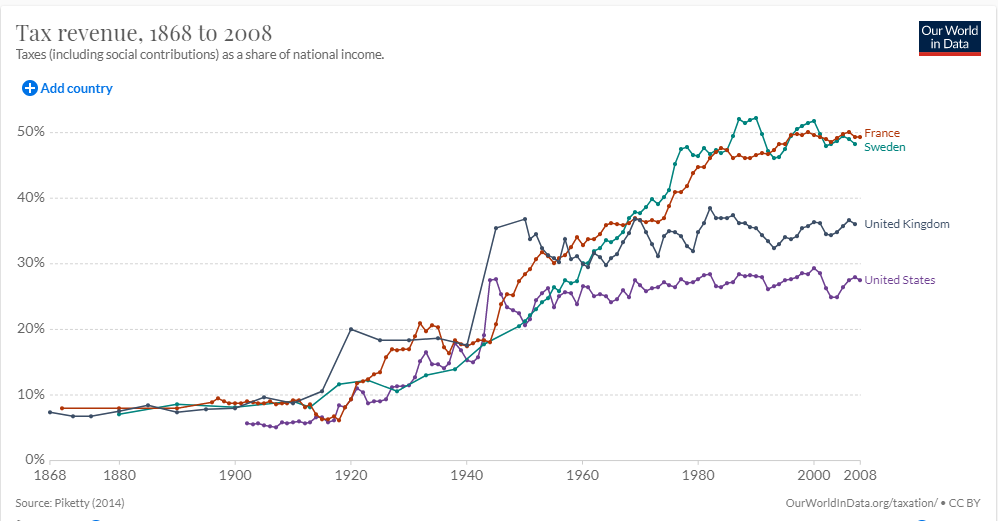

Apart from the fact that all-pervasive media has enabled ordinary people everywhere to focus upon the fallibility of the political class, at a deeply personal level recent history has witnessed a massive increase in the social burden of government. Few of us appreciate that one of the chief reasons the Industrial Revolution happened, releasing mankind from the drudgery of an agricultural economy, was the fact that aggregate taxation was less than ten percent at that time.

Of late, the unpopularity of ever- increasing taxation needed to feed a monstrous growth of the civil service is why the graph on the right began to flatten in the 1960s and the debt burden of nations then took over. Government debt has itself now become unmanageable which has prompted a last-resort of governments, most evidentially in the current Biden administration, to attempt to administer wealth taxes.

Of late, the unpopularity of ever- increasing taxation needed to feed a monstrous growth of the civil service is why the graph on the right began to flatten in the 1960s and the debt burden of nations then took over. Government debt has itself now become unmanageable which has prompted a last-resort of governments, most evidentially in the current Biden administration, to attempt to administer wealth taxes.

It should thus surprise nobody that there has been a steady increase of political rhetoric in the most indebted nations posing moral arguments why governments should be able to gain a bigger slice of the perceived wealth of their citizens. Simultaneously there has been a growing and well-founded public fear that orthodox currencies no longer represent fair value. Thus it should not also not surprise readers that one of the compelling attractions of the blockchain system has been the total wealth anonymity it has offered its users.

More and more ordinary citizens are simultaneously discovering the even greater benefits of greatly lowered costs and freedom from red tape that blockchain use confers upon their financial transactions because banks and other financial institutions are not creaming off their percentages. Meanwhile with the recent announcement by global credit card company Visa that its users will be able to transact business in blockchain currencies, crypto has clearly come of age.

The rapid global growth of crypto currency use furthermore suggests that a single world currency will eventually result making it extremely difficult for national governments to tax citizens in their traditional manner, forcing them to back-track from their present all-intrusive involvement in the lives of people and hopefully leading in turn to consensual electronic law-making, an end to political parties with their “winner takes all” approach to government and a tectonic shift in the way mankind governs and regulates itself.

The rapid global growth of crypto currency use furthermore suggests that a single world currency will eventually result making it extremely difficult for national governments to tax citizens in their traditional manner, forcing them to back-track from their present all-intrusive involvement in the lives of people and hopefully leading in turn to consensual electronic law-making, an end to political parties with their “winner takes all” approach to government and a tectonic shift in the way mankind governs and regulates itself.

Already from ShareFinder’s perspective, it now appears probable that stock exchanges as we know them will become obsolete in the foreseeable future to be replaced by something like the crypto exchanges that are now flourishing across the planet. Such exchanges have a huge advantage over traditional security exchanges since they offer instant trading and do not necessarily have any specific geographic location nor restricted trading hours while the security and transferability of corporate shares is guaranteed by the block chain algorithm. Already many thousands of blockchain-based capital-raises by small businesses seeking development capital are edging out stock exchanges because of the total absence of the complex paperwork that is traditionally required by the latter.

As a consequence it seems likely that ShareFinder International will in future be servicing investor clients who do not necessarily have any fixed geographic locations and who will need quick decision-making tools and even faster expediting. They have accordingly developed the ShareFinder 6 Mobile module which operates off the cloud-based ShareFinder 6 Professional database in Android for operation on tablets and mobile phones.

It will automatically build and monitor portfolios that are tailored to personal risk profiles of securities listed on the five most important international markets and provide users with the means to recognise underperforming investments while simultaneously offering top-performing replacements.

If you would like to familiarise yourself with this new world, I would thus encourage you to join in the ShareFinder International Telegram group at: t.me/SharefinderGroup which will enable you to learn a bit more about the rapidly growing world of decentralised finance and participate in the upcoming ShareFinder issuance. You will then be able to post any questions about ShareFinder International products or the raise and get answers from the Sharefinder International team.

Simultaneously ShareFinder International is launching its own crypto currency nominally known as the ‘ShareFinder’ which will hold as its asset base direct participation in the ownership of the ShareFinder master algorithm and the global profitability of the company.

While the jury is still out as to whether cryptocurrencies represent an investment rather than a universal payments system, for those who initially bought Bitcoin at $108.58 in 2014 the cryptocurrency has certainly yielded dramatic growth attaining a value of $63 346.79 in April this year. Meanwhile, compared with other crypto currency issues that we have examined, the ShareFinder-backed tokens would appear to offer significantly more attractively value since they are be backed by an asset that has a very long and reliable track record. As such, ShareFinder International is confident its tokens will quite rapidly trade up in value offering investors the potential for significant capital gains.

While the jury is still out as to whether cryptocurrencies represent an investment rather than a universal payments system, for those who initially bought Bitcoin at $108.58 in 2014 the cryptocurrency has certainly yielded dramatic growth attaining a value of $63 346.79 in April this year. Meanwhile, compared with other crypto currency issues that we have examined, the ShareFinder-backed tokens would appear to offer significantly more attractively value since they are be backed by an asset that has a very long and reliable track record. As such, ShareFinder International is confident its tokens will quite rapidly trade up in value offering investors the potential for significant capital gains.

Are Blockchain currencies an investment?

By Richard Cluver

My awakening interest in cryptocurrencies has stirred a number of readers to ponder the likely future impact of the blockchain algorithm upon their own lives in future and, more profoundly upon how it might dramatically re-shape the global economic system of the future.

For those of you who are still a little bemused by the whole issue, let me start with Wikipedia’s comment that a blockchain is a growing list of records, called blocks, that are linked together using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data (generally represented as a Merkle tree). The timestamp proves that the transaction data existed when the block was published in order to get into its hash. As blocks each contain information about the block previous to it, they form a chain, with each additional block reinforcing the ones before it. Therefore, blockchains are resistant to modification of their data because, once recorded, the data in any given block cannot be altered retroactively without altering all subsequent blocks.

The practical reality is that anyone may create and own a blockchain wallet within which he may store both cryptocurrencies and, among numerous other items, the registration details of things he owns. Wallets are thus something like a bank vault. Anyone who pleases may access this wallet and note its contents but nobody other than the owner who possesses the cryptographic “key” to the wallet can know who the owner is. You might, for instance, lodge within a wallet an entire share portfolio worth billions. People choosing to look inside that wallet are free to do so but cannot either add or subtract from the contents and, more importantly, cannot determine who the owner is unless the actual owner decides to disclose his ownership.

Blockchains technology therefore has many practical uses. Retail giant Walmart, for example, three years ago initiated an experiment which has been used to allow retailers and consumers to track the provenance of meat and other food products from their origins to stores and restaurants.

As of 2018, Walmart and IBM were running a trial to use a blockchain-backed system for supply chain monitoring for lettuce and spinach — all nodes of the blockchain were administered by Walmart and were located on the IBM cloud. One cited benefit is that the system could enable rapid tracing of contaminated produce.

So it is important to understand that while cryptocurrencies like Bitcoin, and the New ShareFinder coin that is shortly to be launched by ShareFinder International, rely upon a blockchain to ensure that the coins can be readily transferred between traders, to guarantee the anonymity of their owners and to similarly guarantee that the coins can never be counterfeited, such coins are simply a by-product of the system.

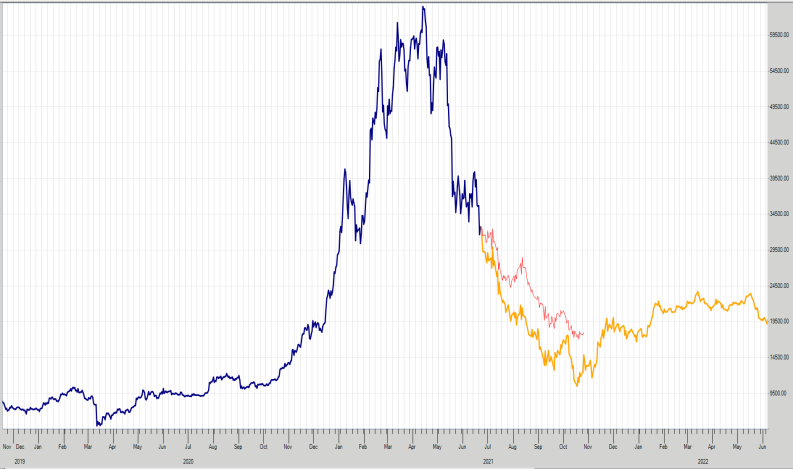

Against this background there is a raging current debate about whether cryptocurrencies represent a currency or an investment and just one glance at the graph on the right illustrates why this is so. In the past 12 months the US$ value of Bitcoin surged from $8 790 to $64 836 and back to a current $39 308 having recently touched a low of $31 114.

Against this background there is a raging current debate about whether cryptocurrencies represent a currency or an investment and just one glance at the graph on the right illustrates why this is so. In the past 12 months the US$ value of Bitcoin surged from $8 790 to $64 836 and back to a current $39 308 having recently touched a low of $31 114.

Clearly then, traders have been able to make huge fortunes by initially going long on Bitcoin and more recently shorting them. That suggests that Bitcoin are a commodity like, for instance copper which, if you consider my next graph, has over the past 20 years, seen a low in 2001 of $13.39 and a recent high of $107.10 on May 11 before falling back to a low of $90.88 this week.

Given that someone buying a shipment of copper ingots would need to fund the warehousing costs of holding copper since its 2001 price bottom, the fact that the metal has delivered a mean compound growth rate of 3.6 percent annually over the past 20 years implies that it is actually a very poor investment when compared to say an average Wall Street share which, measured by the performance of the Standard and Poors 500 Index over the same period, that I have illustrated in my first graph on this page, delivered compound 7.6 percent.

Given that someone buying a shipment of copper ingots would need to fund the warehousing costs of holding copper since its 2001 price bottom, the fact that the metal has delivered a mean compound growth rate of 3.6 percent annually over the past 20 years implies that it is actually a very poor investment when compared to say an average Wall Street share which, measured by the performance of the Standard and Poors 500 Index over the same period, that I have illustrated in my first graph on this page, delivered compound 7.6 percent.

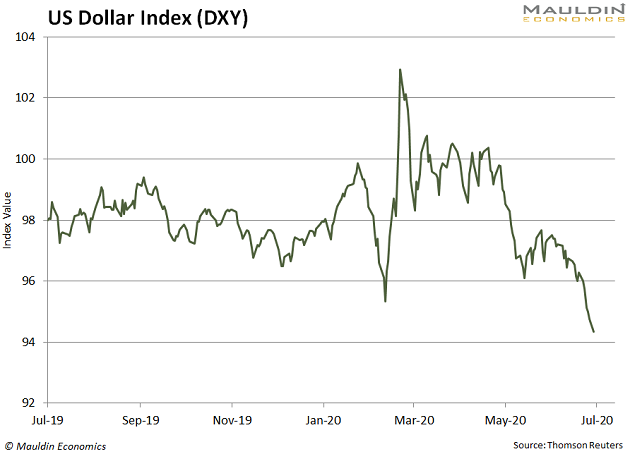

And to complete this argument, many developing world people argue that the volatility of their national currencies suggests that it is wise to “invest” in US Dollars. So is the US Dollar an investment or a commodity?  If you consider my next graph, which traces the movement of the US Dollar relative to the South African Rand, you might similarly deduce that it would have been a poor investment over the past 20 years since, from its 2001 low of R7.66 to the dollar on February 28 of that year to its recent low of R13.40, it has delivered an effective compound growth rate of 3.3 percent. So it is probably fair to conclude that either the Dollar or the Rand, and possibly both have, graphically anyway, behaved like commodities.

If you consider my next graph, which traces the movement of the US Dollar relative to the South African Rand, you might similarly deduce that it would have been a poor investment over the past 20 years since, from its 2001 low of R7.66 to the dollar on February 28 of that year to its recent low of R13.40, it has delivered an effective compound growth rate of 3.3 percent. So it is probably fair to conclude that either the Dollar or the Rand, and possibly both have, graphically anyway, behaved like commodities.

Certainly, however, neither currency might be regarded as secure investments. Their extreme value volatility and poor value growth surely put paid to that argument.

By comparison, investments are also expected to yield a regular dividend – that’s what the tax man demands when you seek to declare a speculative purchase as an investment – and nothing better fits that definition than the category of corporates whose shares are listed within the ShareFinder system as ‘Blue Chips.’ From an index low of 3281.366 in September 2001 New York Blue Chips rose to a recent peak value of 18 700.463 which, if you care to calculate it, represents compound annual average growth of 8.8 percent. Add to that an average dividend yield of 2.22 percent and you obtain, by comparison, a very attractive total return of more than eleven percent which clearly tops all the other options I have so far discussed….until you consider crypto currencies which have demonstrably delivered 618 percent over the past year and since 2015 have delivered 526.31 percent compound.

By comparison, investments are also expected to yield a regular dividend – that’s what the tax man demands when you seek to declare a speculative purchase as an investment – and nothing better fits that definition than the category of corporates whose shares are listed within the ShareFinder system as ‘Blue Chips.’ From an index low of 3281.366 in September 2001 New York Blue Chips rose to a recent peak value of 18 700.463 which, if you care to calculate it, represents compound annual average growth of 8.8 percent. Add to that an average dividend yield of 2.22 percent and you obtain, by comparison, a very attractive total return of more than eleven percent which clearly tops all the other options I have so far discussed….until you consider crypto currencies which have demonstrably delivered 618 percent over the past year and since 2015 have delivered 526.31 percent compound.

One might, however, argue that since cryptocurrencies cannot by definition deliver an annual dividend, with a growth rate like that, who cares? Add to that they offer perhaps the ultimate medium of exchange because you are able to swop them for virtually any global currency you choose and, if that is important to you, do so beyond the prying eyes of the tax man, one can perhaps argue that nothing since the demise of the Gold Standard, has offered such flexibility.

Certainly, nothing quite like it has been on offer to the investment community since gold sovereigns, gold dollars and Maria Theresa Thalers – the silver bullion coin featured as the favoured means of exchange in the exploits of Lawrence of Arabia – which has been minted continuously since 1741. (All Maria Theresa Thalers minted after 1780 bear the date ‘1780’ and probably between 400 to 800 million Thalers have been minted since thecoin was introduced and is still being made by the Austrian Mint today.)

(All Maria Theresa Thalers minted after 1780 bear the date ‘1780’ and probably between 400 to 800 million Thalers have been minted since thecoin was introduced and is still being made by the Austrian Mint today.)

Arguably that is why cryptocoins are currently offering such explosive growth!

So, compared to the world’s principal stock exchanges, what is the current outlook for Bitcoin? Well for comparison let me start with the New York Stock Exchange which, on the right, ShareFinder suggests is likely to bottom out around August 10.

By comparison, ShareFinder’s projection graph on the right suggests that the recent price consolidation attempt by Bitcoin has failed and that further declines are likely until mid-October when you are likely to enjoy your best buying opportunity.

By comparison, ShareFinder’s projection graph on the right suggests that the recent price consolidation attempt by Bitcoin has failed and that further declines are likely until mid-October when you are likely to enjoy your best buying opportunity.

So let me end this column as I have done previously by noting that if cryptocurrencies do not conform to either the strict definitions of currencies or investments, they are undoubtedly going to play an increasingly important part of our futures because they are in so many ways pointing us to the future of world monetary and economic history. We who have lived all our lives with banks which moved money around on our behalf, stock exchanges which allowed us to profitably invest our savings and tax men who went around gathering in as much of what we earned as they could legally get away with, are now able to glimpse a future in which all three are becoming irrelevant.

What is going to give the new Sharefinder cryptocurrency special status is that, unlike the rest, it will be backed by being linked to the shares of an established global company. Whether the currently available cryptocurrencies represent a speculative currency or an actual investment is still an open question but I believe the ShareFinder Coin will thus prove to be a genuine investment which will over time pay handsome and rising dividends to its investors and simultaneously thus enjoy a rising value. In time then, it should prove to be an international Blue Chip.

Tesla and Other Bubble Stocks Have Deflated Just Like 2000

By James Mackintosh of the Wall Street Journal

Fashionable areas of clean energy, electric cars, cannabis stocks and SPACs have dropped sharply this year, in an echo of the dot-com era

Elon Musk’s comments on assets like bitcoin and dogecoin have helped send prices sky high – and crashing down – over the past year. WSJ explains Musk’s influence on cryptocurrency investors, and why some experts think the ‘Dogefather’ is taking investors for a ride.

Is the dot-com bust happening again right under our noses? It might seem an odd claim, but there is a remarkable resemblance between the speculative boom-to-bust of late 1999 and the first half of 2000 and what’s happened over the past nine months in the fashionable areas of clean energy, electric cars, cannabis stocks and SPACs.

If the parallel continues it bodes ill for investors who joined the excess late. The trendy stocks—led by Tesla—are already down a quarter to a third from this year’s highs. But there are reasons to hope that, unlike at the turn of the century, the malaise won’t spread to the rest of the market.

The similarities are in both performance and investor behavior. The late-1999 fear of missing out on internet stocks inflated the Nasdaq Composite 83% from the end of September to its March 2000 top. From September last year to this year’s highs, Invesco ’s solar exchange-traded fund jumped 88%, Blackrock’s global clean energy ETF jumped 81%, and Ark’s innovation ETF 70%.

Back then the leading large bubble stock Cisco rose 133%, while today’s leading bubble stock—Tesla—was up 110% from September to peak. Pure dot-com areas roughly tripled, just as cannabis funds have this time.

Even the time of year is similar, with the fashionable sectors peaking in February and March this year, while the dot-com high was reached on March 10, 2000. After the bubble burst, the performance by mid-June—now—followed the same course, with losses of a quarter to a third from this year’s frothy areas, and a loss of a quarter in the Nasdaq in 2000 ( Cisco held up a little longer).

How Cryptocurrencies rely on blockchain technology

By David Farelo of CURRENCY HUB

A cryptocurrency is a virtual currency or digital asset that can be used to make secure, online payments secured by computational phenomena called cryptography, which is hosted on a decentralised network referred to as the blockchain.

A cryptocurrency is a virtual currency or digital asset that can be used to make secure, online payments secured by computational phenomena called cryptography, which is hosted on a decentralised network referred to as the blockchain.

All cryptocurrencies are powered by blockchain technology which is essentially a database of transactional information known as a ledger, enforced by an independent, peer-to-peer network of over 100 000 computers around the world. Each block in the chain contains a number of transactions and every time a new transaction occurs, a record of that transaction is added to every participant’s ledger.

This data is verified by the community and the validations performed by the computational sums determine the issuance and or reward of a cryptocurrency like Bitcoin.This makes it nearly impossible to counterfeit or double-spend when using cryptocurrencies and presents numerous investment opportunities through disruptive technology.

All cryptocurrencies are powered by blockchain technology. The defining feature of cryptocurrencies is that they are generally not issued by a central authority, rendering them theoretically immune to government interference or manipulation.

The first blockchain technology was Bitcoin, created in January 2009 by an individual or group using the alias Satoshi Nakamoto. Bitcoin offered the promise of an online currency secured without a central authority, unlike government-issued currencies.

There are no physical Bitcoins, only balances associated with a cryptographically secured public ledger. Think of Bitcoin as digital gold, a store of value, but not something you necessarily transact with.

Today, there are thousands of alternate cryptocurrencies, known as altcoins. Some altcoins that were spawned by Bitcoin’s success include Ethereum, Litecoin and Ripple. Ethereum is currently the second largest cryptocurrency and enables the deployment of smart contracts and decentralised applications. Ethereum has its own programming language, which runs on a blockchain that enables developers to build and run distributed applications on the Ethereum blockchain. Think of Ethereum as an open source network like the internet.

The potential applications of Ethereum are wide-ranging. It is powered by its native cryptographic token, ether (commonly abbreviated as eth). Ether is used by developers to build and run applications on the platform for two main purposes. It can be traded as a digital currency on exchanges in the same way as other cryptocurrencies and used on the Ethereum network to run applications.

Thanks to a peer-to-peer mindset and a blockchain like Ethereum, thousands of altcoins offer efficient and inexpensive ways to transact digitally, on the internet, using cryptocurrencies, stablecoins, security tokens and utility tokens. The most disruptive force on the Ethereum network is referred as DeFi (decentralised finance), which attracts a myriad of integrated services and company launches. These transactions rely on the mining of cryptocurrencies and the launch of new services referred to as ICO’s (Initial Coin Offerings). ICO’s churn out new currencies and ongoing development to improve the blockchain and verification of ledger activity as well as incentivise and reward participants.

The decentralised database is managed by multiple participants and is known as distributed ledger technology (DLT) where transactions are recorded with an immutable cryptographic signature called a hash. In simple terms, the blockchain can be described as a data structure that holds transactional records and ensures security, transparency and decentralisation. You can also think of it as a chain of records stored in the forms of blocks, which are not controlled by a single authority, hence the peer-to-peer community.

The blockchains that support Bitcoin and Ethereum are constantly growing as blocks are added to the chain, which significantly adds to the security of the ledger. Participants are attracted to the networks for several reasons, such as to mine cryptocurrencies, which involves verifying transactions recorded in the ledger to generate Bitcoins or to develop disruptive services made possible by smart contracts and decentralised finance (DeFi). Think of banking, investing, lending, remittance, insurance to name just a few and how a peer-to-peer community is cutting out the middlemen in the traditional financial world, increasing efficiency and reducing costs, all thanks to blockchain technology.

CURRENCY HUB is a crypto advisory supporting crypto arbitrage, OTC and FOREX services.

Long Humanity

By John Mauldin

By John Mauldin

I like to say designing the Strategic Investment Conference agenda is my personal art form. There’s more to it than just picking speakers and topics. The order matters, too, as does each session’s combination of viewpoints—especially pairing the speakers in panels and letting them test their views against one another.

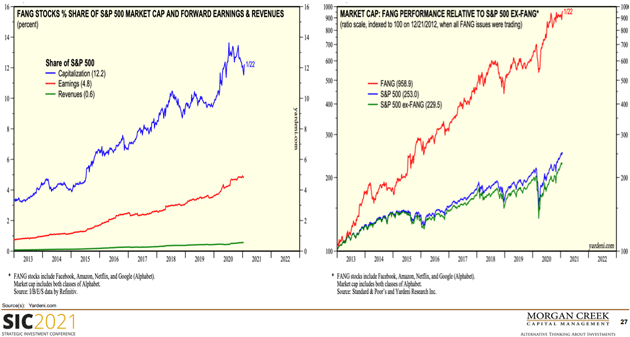

This year’s SIC was a blockbuster. Speaker Mark Yusko isn’t optimistic for 2020’s new crop of day traders or the (somewhat) less enthusiastic investors who have piled into the “FANG” stocks. He noted those four (Facebook, Amazon, Netflix and Google/Alphabet) represent less than 1% of S&P 500 revenues but account for 12% of the index… and 4X the rest of the index’s gain since 2012.

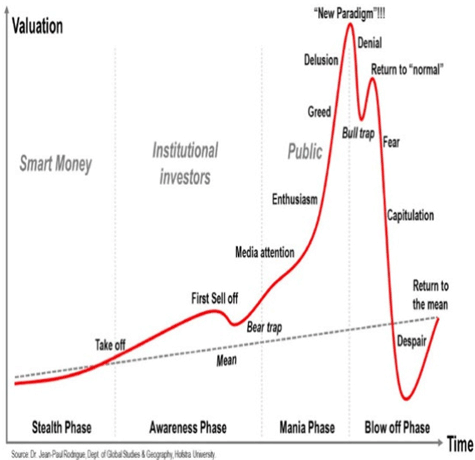

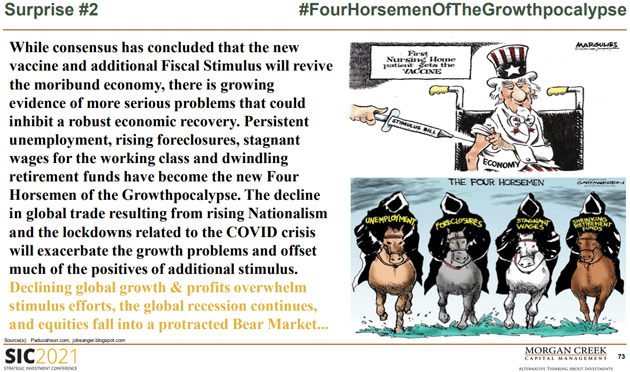

Mark believes these results from central bank stimulus, not just last year but dating back to the financial crisis. Valuation bubbles historically don’t end well, as he showed in this all-too-familiar illustration.

Mark believes these results from central bank stimulus, not just last year but dating back to the financial crisis. Valuation bubbles historically don’t end well, as he showed in this all-too-familiar illustration.

The sad part is the kind of “mean” return shown in that dotted line is actually pretty good. It would suffice for most investors who have reasonable goals. But the allure of “more” entices them to expect too much and over time, they don’t even reach the average.

From there, Mark went on to talk about energy, gold, China, Bitcoin, and more. While he thinks the economy could rally a bit more, that’s not the same as a “return to normal.” COVID-19 and its fallout will be headwinds for years.

If you can’t see the cartoon on the right, the “Four Horsemen of the Growthpocalypse” are unemployment, foreclosures, stagnant wages, and shrinking retirement funds. To which I would add—millions of Americans, approximately 50%, have no retirement funds at all except for Social Security so there’s nothing to shrink. Another 15 to 20% have less than $100,000.

If you can’t see the cartoon on the right, the “Four Horsemen of the Growthpocalypse” are unemployment, foreclosures, stagnant wages, and shrinking retirement funds. To which I would add—millions of Americans, approximately 50%, have no retirement funds at all except for Social Security so there’s nothing to shrink. Another 15 to 20% have less than $100,000.

That’s not optimistic, but Mark didn’t leave us with gloom and doom. He sees a lot of opportunity in Bitcoin and other cryptocurrency assets. But more interesting, he has a very different view of the current boom in Special Purpose Acquisition Companies, or SPACs. Many analysts see them as borderline shady “blank check” entities with no history or assets. But Mark thinks they are proving to be a useful end-run around an initial public offering process that has become slow, expensive, and unfair to both investors and company founders. It’s why so many “unicorn” startups are remaining private far longer, and some may never go public. The result is less opportunity for small investors.

I have seen the SPAC space from both sides. I have several friends who have created what had become successful companies. I will soon be involved with a private company that will be using a SPAC to go public in a much more democratic and far less expensive way than an IPO.

While it should be intuitively obvious, not all IPOs are winners. Perhaps the most egregious were some of the late 1990s dot-com companies (Pets.com?) But I imagine more than a few of us wish we could have participated in the Facebook or Netflix IPOs. I suspect at the end of the day, SPACs will likely have a similar track record.

Pleasing Markets

Mark Yusko was followed by Bill White and Howard Marks But I haven’t told you about Richard Fisher, former Dallas Fed president. In that role from 2005–2015, he sat in some interesting meetings during the crisis years. I’m sure there’s much he still can’t reveal, but he gave us a few hints. More important, though, was the insight Fisher gave us into the current Fed’s thinking. It appears to have changed radically just in the few years since he left. Now, I would argue radical change is just what the Fed needs, but it must be the right kind of change. Instead, it has become even more politicized, partly because of Trump and partly because the pandemic created an entirely new kind of crisis.

There are calls from many corners that the Federal Reserve should be turned into some type of environmentalist institution. Shouldn’t the Fed use its balance sheet for the Green New Deal and climate change? Still others argue that the Fed should be thinking about social justice.

The Fed was originally charged with preventing bank crises and controlling inflation. In 1977, Congress—in what I think shifted responsibility from where it should be—gave the Federal Reserve an explicit mandate for full employment. That should be a congressional mandate, but now Congress can point its collective fingers at the Fed.

Like it or not, the Fed is now back in cahoots with the Treasury Department, to the point a former Fed chair now heads Treasury, and both Fed and Treasury work closely with Congress to “coordinate” policy that pleases the markets. Fisher thinks Jerome Powell is making the best of a bad situation, but he isn’t sure how long Powell will be there. His term expires later this year, and it looks like Lael Brainard may be the next chair. That might lead to some other departures, so a year from now we could have a significantly different Fed. I am not sure the markets are ready for that.

I am very concerned Congress will want to use the Federal Reserve balance sheet to fund a whole slew of new programs, which might sound nice in theory, but it will have the high probability of distorting the actual working of the economy.

Where the Future Is

In a conference full of highlights, our final panel was the highest. My good friend David Bahnsen interviewed Richard Fisher, Bill White, Felix Zulauf, and yours truly. In almost 90 minutes, we went around the world several times.

David kindly gave me the first pitch, asking me to sum up what we’d heard.

It’s probably going to come as no surprise that I’m going to kind of pick a middle muddle through path. I really think that Bill White nailed it when he said it’s a process. We have a short-term process where we’re clearly going to have some inflation. In my conversations with Bill, short-term to him is six months, a year, 18 months. It’s not two or three months.

Then, I think the forces that Lacy and others have been talking about, that Felix was bringing up, begin to come back in. Then, we have to see what happens. I think the real danger in all of this is the Federal Reserve does what Ben Hunt calls, “loses the narrative.” If they lose the confidence and trust of the markets, it’s game over. It would make this last week’s volatility look like a picnic. Going back to what Richard said, I think they need to start giving us some language that makes us realize that the captain is in the pilot chair. Daddy’s home and all is going to be right with the world.

Right now, they say we don’t need a pilot. It is on auto pilot. We’re not going to pay any attention to this turbulence. Don’t mind the crowds. Nothing is happening here. That’s not, I don’t think, the proper message. I think the message [they should be saying] is we’re here. We’re paying attention. Telegraphing 30 months out [is fraught with danger]. They don’t know what’s going to happen in 30 months, let alone one or two quarters. None of us do.

If they have to pull that back in the fourth quarter because we don’t know what’s going to happen, then there is a real potential they lose some of their credibility. [Again, what Ben Hunt calls losing the narrative.] I think this forward guidance and trying to telegraph stuff is precisely the wrong thing, especially 30 months out… I agree with Richard or Bill. I think the business of setting the price for the most important thing in the world. Howard Marks said this actually earlier. Setting the price for money is not something that the federal reserve, central bank, should be in the process of doing.

[This has always made me uncomfortable. My personal feeling is that if we allow the markets to set the price for short-term rates, they would be far from where they are today. And if they work? That would mean that the market is absorbing the impact.]

Since I mentioned forward guidance, and Richard Fisher was actually one of the guides, he jumped in to expand on my point.

Looking at so-called forward guidance in terms of the dot plot and what it tells you and what they issue, I wouldn’t pay a lot of attention to it, as John just mentioned, long term. Why? You can never forecast very long term, except for you end up at 2% inflation because that’s your target and you have to plot it as such.

Secondly, you have to remember, the people that are sitting around that table won’t be there long term. Presidents turn over. We have two big ones next year, by the way. Then you also have the governor’s turnover and the chair’s turn over. And then you have the rotation of the votes amongst the banks and how the New York Fed will turn over.

Don’t put too much emphasis on this forward forecasting exercise known as guidance. It’s a very imperfect tool, and I actually think Powell does the right thing at his press conferences to downplay it. It’s how he thinks at the moment, and we’re basically guided by the nearest term.

They have gone out and said, though, they’re not going to change for a very long time. I don’t think the market believes that, and I think that will change over the year or over the next few years.

Felix Zulauf noted China’s central bank is bucking the trend, tightening policy while the others stay loose.

I think at the present time, the one central bank that is operating very differently is China. China seems to run to a different drummer. China is tightening monetary policy. They are also tightening fiscal policy. They are creating decent positive real rates of return in the interest rate markets. In the fixed income markets. Because they understand that if they want to perform well long term, you need high savings rates. You need interest rates that attract money… I think they are actually maneuvering in a much more capitalist way when it comes to economic policy.

Whereas the Western governments and central banks together operate in a much more socialist fashion by bailing out everybody and helping the system and taking the high price of leveraging up the system, which is becoming a danger over the long term.

[JM here: What kind of crazy upside-down world do we live in where a Communist central bank is the most conservative—what Charles Gave would call the Wicksellian bank—and the theoretically “free market” central banks are driving real interest rates well below zero?]

Later, Bill White talked more about this danger and how the debt Western central banks have created and encouraged is going to spark a crisis. How do you prepare for that? How do we prepare the system for it? Here’s Bill.

As you both said, take out some insurance. When you’ve got some money, stick it in the bank. I think another one of these buffers. Assuming you’re being realistic here—and I think I am being realistic, and agreeing with Felix in particular. A crisis is coming and in that crisis, there’s going to be a lot of bankruptcies and insolvencies. What steps are we taking now to ensure that those debt problems that will be resolved get resolved in an orderly way, as opposed to a disorderly way?

We know that the courts are already creaking, even in the United States and the United Kingdom, with commercial stuff. The IMF, the BIS, the OECD, the Group of 30. They’ve all come up with big studies in recent years to show our bankruptcy proceedings, whether in the courts or out of the courts, are inadequate. If you look reality in the face, and this is all part of the resiliency stuff that everybody’s talking about these days, another crisis is coming. The least we can do is to make ex-ante preparations so that we can deal with it in as good a fashion as we can. I don’t think that’s happening and that’s unfortunate.

Bill was describing what may be part of the “Great Reset” I expect. Much of the world’s debt is going to get liquidated somehow. Bankruptcy is one method, and it could be a better one if we had a better-prepared court system.

David closed by asking each of us where, ten years from now, we will wish we had invested in the 2020s. Bill thought Europe, which he believes has been a laggard but is poised to catch up. Felix agreed Europe will outperform, but said he would go with China because it is at the forefront of new technologies.

Richard Fisher? Noting China’s repressive system in the end can’t compete with free markets, he said he would put his money in Texas, because “That’s where the future is.” [I have a paper in my reading queue that talks about the economic powerhouses of Dallas, Austin, Houston, and San Antonio. Richard may be on to something.]

As for me, you won’t be surprised…

My answer is I’m still long humanity. I want to be long, emerging technologies, especially biotechnology. If we’re talking 10 years. I’m short governments. We’ve been talking about the problem with governments. I am long humanity. I think the coming technological revolutions and transformation are going to be astounding. There’s going to be massive fortunes made and that’s where I’m putting most of my money. It really is.

The Second Derivative

By Jared Dillian

So, we have 5% inflation. Awesome. Longtime readers know I’ve

been predicting runaway inflation for nearly a year now.

been predicting runaway inflation for nearly a year now.

Well, here we are. The Consumer Price Index, economists’ go-to inflation metric, soared 5% in May from a year earlier. It’s the fastest increase since 2008. Some people are saying this is transitory, either for political reasons… or because they’re stubborn. Maybe both.

The inflation we’re experiencing is not transitory. We have permanently reset prices higher. How much higher? Expect to see 10 percent inflation in 2022.

Part of this ties back to the labor shortage we’re seeing right now. Companies are so desperate for workers that a Florida McDonald’s is offering people $50 just to sit down for an interview.

It’s bananas.

It’s hard to get someone to work for $10 an hour when the government is paying them more to stay home. Wages are sticky. If you start paying people $25 an hour, that is not going back down—ever. That is the new base for wages. It will only go up from there.

It’s hard to get someone to work for $10 an hour when the government is paying them more to stay home. Wages are sticky. If you start paying people $25 an hour, that is not going back down—ever. That is the new base for wages. It will only go up from there.

And those labour costs will get passed along to the consumer. You!

Of course, there’s more to the inflation story than just higher wages. So, get ready—you’re going to hear from me a bit more than usual this week.For now, keep this in mind—I am not the least bit panicked about runaway inflation. And you don’t need to panic, either.

I’ve already made lots of money on my inflation trades. And there are still opportunities for you to do the same.

|

School’s in session. Let’s talk about math.

Go back to your calculus class senior year in high school. You take the derivative of y with respect to x. You are finding the sensitivity to the change in the function with respect to a change in the argument. In practical terms, this is the slope of a line or the velocity of an object.

Then, take the derivative of the derivative—the second derivative. In practical terms, this measures the curvature of a line or the acceleration of an object. As it turns out, people have a very difficult time with the second derivative.

The second derivative is everywhere in finance. It is convexity in bonds or gamma in options. When someone blows up in the financial world, it is usually a failure to understand the second derivative. Human beings think linearly and statically. You may know your exposure here, but you may not know it over there.

Some second derivatives, like convexity and gamma, are measurable and known. Some of them are hidden and unknown. I’ve talked about hidden gamma before in The 10th Man, which we saw in March 2020—the point where people liquidate their positions and selling accelerates.

Once you see the second derivative, you can’t unsee it. It is everywhere you go. And then you’re on the lookout for it.

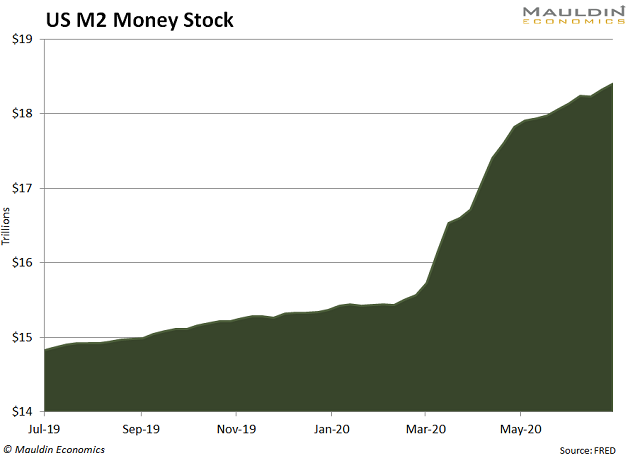

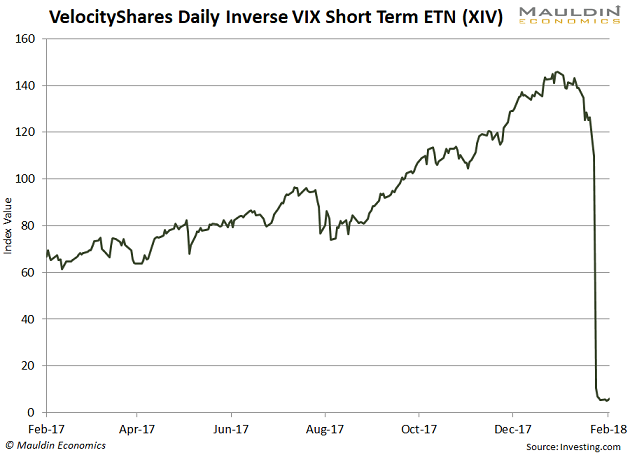

The second derivative produces charts like this:

The second derivative produces charts like this:

And then people wonder what the hell happened.

Stocks Have Convexity

The first thing to understand is that stocks have convexity. Some stocks are positively convex, and other stocks are negatively convex.

If that sounds like Greek to you, here’s a simpler way to think about it…

- A positively convex stock goes up faster than it comes down.

- A negatively convex stock goes down faster than it goes up.

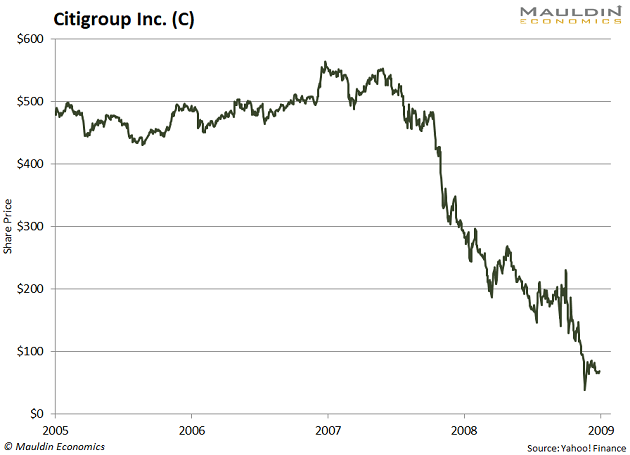

A lot of stocks, like the banks, were negatively convex in 2007. The banks had sold a great deal of optionality, which turned them into engines of negative convexity. They went up slowly and came down fast, which is roughly the payoff of a short option.

You can see this with Citigroup Inc. (C) in the next chart.

You can see this with Citigroup Inc. (C) in the next chart.

In general, tech stocks and biotech stocks are positively convex. But there are exceptions. And there are positively convex stocks in plenty of other industries, including retail, energy, and mining.

This doesn’t mean that you can’t have a negatively convex stock in your portfolio, but on balance, your portfolio should be positively convex. If bad things happen to the market, you want good things to happen to you.

A lot of people don’t realize that stocks have embedded convexity—they look at the chart and it seems pretty straightforward. Stocks go up and down. But sometimes they go up or down very rapidly.

Most of the analysis I do on stocks is not looking at static financial statements. It’s looking at how the underlying business can change in a convex fashion.

Convexity ends up fooling most people—they buy something that is linear that ends up being nonlinear in a malignant way. It’s a difficult concept to understand.

Many people dismiss the meme stocks like GameStop Corp. (GME) and AMC Entertainment Holdings, Inc., but there is a lot of convexity there, and gigantic opportunities. Convexity certainly fooled the people who were short GME.

Convexity is also created by liquidity, which is something I understand well, having worked on a program trading desk. If you own a stock that trades 500,000 shares a day, try to imagine what would happen if it traded 50,000,000 shares in a day. There is no place for it to go but up, or down.

Bonds

I had positions in preferred stock and high-yield bond funds up until recently. I sold them because of the massive negative convexity.

I try to keep things as simple as possible—high yield can’t go up much more, but it can go down a lot. One way to win, many ways to lose.

The coupon you get off high-yield bonds is like the premium you get from selling options. Sometimes (when the Fed isn’t involved), that premium is large and bonds become more attractive. People who understand income investing know intuitively about the negative convexity present in these strategies.

One of the tragedies of Zero Interest Rate Policy is that it has forced retirees to load up on negative convexity in search of income, usually in the form of corporate bonds and high dividend stocks.

In the old days, you could leave money in the bank, which was essentially zero convexity. If you look at a chart of the average retiree’s portfolio, it’s a series of slow climbs with breathtaking drops. The Federal Reserve, of all people, doesn’t understand convexity.

Once you start thinking about your portfolio in terms of convexity, your outcomes will improve. And I don’t mean just returns—I mean risk-adjusted returns.

Of course, the best way to add positive convexity to a portfolio is to just buy options. But for most people, that is better left to the experts.

It Isn’t Just AMC. Retail Traders Increase Pull on the Stock Market.

By Caitlin McCabe of the Wall Street Journal

Call it the year of the individual investor.

Nonprofessional investors are continuing to upend financial markets and build on their forceful entrance into the arena last year.

Nonprofessional investors are continuing to upend financial markets and build on their forceful entrance into the arena last year.

In the first half of 2021, new brokerage accounts opened by individual investors have already roughly matched the total created throughout 2020, hitting more than 10 million, according to estimates from JMP Securities.

They have driven up the stock prices of companies ranging from GameStop to AMC Entertainment—both have gained more than 1,000% and 2,700%, respectively, this year. They have sent the cryptocurrency dogecoin, originally created as a joke, soaring. And they have banded together on brash forums to inflict punishing losses on institutional investors.

Here are four ways individual investors continue to shape every corner of the U.S. market.

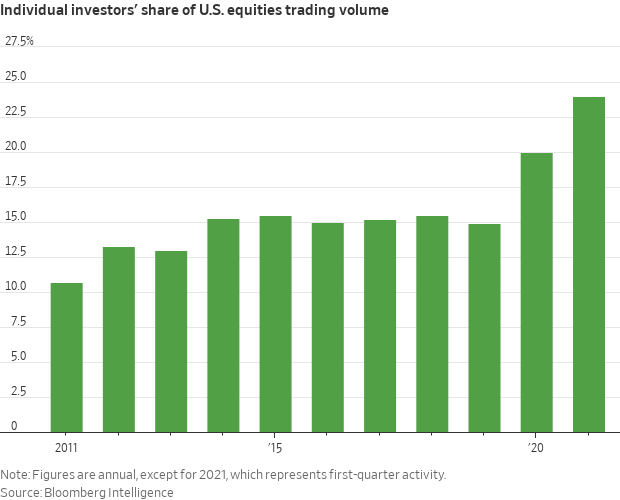

Their trading volume keeps growing. For years, individual investors’ trading activity rarely made a splash on Wall Street. That started to change in 2019, when online brokerages moved en masse to commission-free trading. The Covid-19 pandemic further accelerated individuals’ interest in stocks last year, allowing those stuck at home to try their hands at trading through historic market volatility.

Their trading volume keeps growing. For years, individual investors’ trading activity rarely made a splash on Wall Street. That started to change in 2019, when online brokerages moved en masse to commission-free trading. The Covid-19 pandemic further accelerated individuals’ interest in stocks last year, allowing those stuck at home to try their hands at trading through historic market volatility.

They tend to move in and out of trends quickly. Thanks to the ubiquity of social media, individual investors tend to pile into trades together—either for individual stocks or broad sector themes—and strike quickly to drive the price up in a matter of hours or days. Almost just as quickly, data shows, individual investors pull out of those trades, moving on to the next.

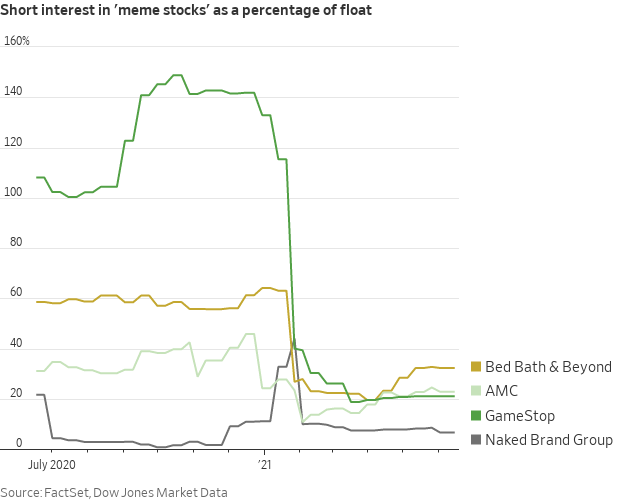

Individual-investor activity is causing short sellers to back off their meme-stock bets. In what has now been cast as a modern-day David and Goliath, individual investors were able to inflict steep losses on short sellers as GameStop’s stock price catapulted higher, forcing the bearish investors to buy back shares to limit their losses. Some investors substantially trimmed their short positions.

More trading is happening off exchanges. The rise in activity among individual investors has corresponded with more trading happening off public stock exchanges—otherwise known as “dark trading.”

Best paid tech CEOs in South Africa

Mybroadband Staff Writer

MTN recently revealed that its former CEO, Rob Shuter received a pay package of R74 million for eight months’ work. Other MTN executives also did well. New CEO Ralph Mupita was paid R31 million while MTN SA CEO Godfrey Motsa received R17 million.

In a country where the average salary in the formal sector is around R22,000 per month, these executive pay packages elicited a big response.Thousands of South Africans viewed this as corporate greed and called for executive pay caps to fight income inequality. After all, how do you justify paying executives millions when lower-level workers are losing their jobs during the pandemic?

The reality is that these salaries are in line with international standards and unless it stays that way, the country will face an exodus of top executives. South Africa has world-class IT and telecoms executives who are in global demand. Shuter, for example, was head-hunted by BT Group and is now the CEO of its enterprise division in the UK.

The need to pay people well to keep them in a company – and South Africa – is, however, only part of the story. Big salaries are an economic reality that fuel economic growth – and they should not be tampered with.

The arguments against high executive pay and income inequality are often moral arguments that confuse merit with productivity. Pay is linked to productivity. A top executive can add great value to a company and create tremendous wealth. This is rewarded with big pay cheques.

Take Elon Musk, for example. He is the driving force behind Tesla which brought the world innovative products and created enormous shareholder value. In return for this exceptional performance, Musk received large bonuses which, in combination with his Tesla shareholding, made him the richest person in the world.

Compare that with the person sweeping the Tesla factory floor. He does not get paid much and may even need a second job to make ends meet. To put the pay gap into perspective, in 2021 Elon Musk earned more per hour – $20 million – than what the factory worker will earn in his lifetime.

This does not seem fair. In fact, it is enough for people to declare capitalism a failed system and reach for Karl Marx’s The Communist Manifesto. The inconvenient truth is that Elon Musk has the ability to be more productive in an hour than what most people will be able to achieve in a lifetime.

This does not mean less productive jobs do not have merit. In fact, quite the inverse. There is tremendous merit in the work done by teachers, doctors, nurses, cleaners, road builders, and cooks. They should be applauded for making society a better place. These professions, however, do not scale well which means their productivity, and therefore their salaries are capped.

A CEO of a large company, in comparison, can create or destroy vast amounts of wealth through a single decision. You have to look no further than South Africa’s state-owned enterprises like Eskom, the SAA, and the SABC to see the impact of poor leaders. They can destroy a company, and even a country.

A good leader, in contrast, can rapidly create wealth and employment and improve the lives of millions of people. As long as executive compensation is linked to the performance of the company and the value they add, high salaries should be celebrated.

This is already happening with sports stars and entertainers. Tiger Woods, Roger Federer, Rafael Nadal, and Serena Williams are idolised for their skills and can make more in a single tournament win than what many other players earn in a lifetime. The best actors, like Tom Cruise or Charlize Theron, pack cinemas and earn millions for a single movie.

The top business leaders have equally scarce and impressive skills and should receive the same respect as their counterparts in sport, music, or movies. This may even help young people to pick business leaders as role models instead of the politicians who vilify them to the detriment of the economy.

There is, however, a caveat. Poor performance should not be tolerated. Just like a sportsman who is dropped from a team if they are out of form, a CEO who is not showing results should be shown the door.

This raises the question of who the best-paid tech CEOs in South Africa are, and how they performed during their tenure as chief executives. Rob Shuter tops the list with his R74-million pay package, followed by Vodacom CEO Shameel Joosub on R43 million and Telkom CEO Sipho Maseko on R22 million.